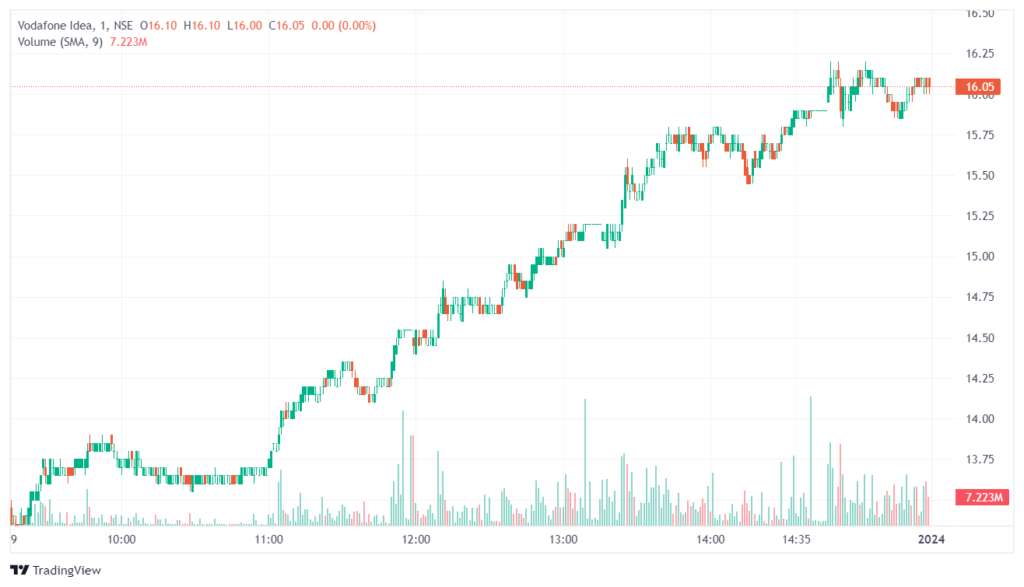

Vodafone Idea Ltd (VIL) shares surged over 20% to Rs 16.02 on Friday after reports emerged that the government is working on a relief package for the debt-ridden telecom operator.

Overview

- Vodafone Idea share rose as much as 21% in morning trade after reports suggested the government is considering a relief package that includes converting interest on spectrum auction instalments and AGR dues into equity.

- The stock pared some gains later but still ended over 13% higher at Rs 15.10 on the BSE.

- VIL shares have gained nearly 101% so far this year, supported by hopes of government relief to address the company’s massive debt.

Government Relief Measures

The government is considering the following relief measures for Vodafone Idea:

- Debt-to-equity conversion: The Centre may convert interest payments due on deferred spectrum auction instalments and AGR dues into equity. This would provide immediate cash flow relief to VIL.

- Moratorium on spectrum dues: The government may allow a 2-year moratorium on spectrum auction instalment payments. VIL has sought a 4-year moratorium.

- Floor tariff fixation: The regulator TRAI may be directed to fix minimum tariffs for mobile services, providing telcos pricing power.

- Reduction in license fee: The Centre is open to reducing license fee and spectrum usage charges prospectively.

- Relaxing AGR definition: Excluding non-telecom revenue from AGR definition could lower levies for telcos.

Impact on Vodafone Idea

The relief measures, if implemented, would significantly improve VIL’s balance sheet position and cash flows.

- VIL faces Rs 1.8 lakh crore in statutory dues, including Rs 1.26 lakh crore in past AGR dues.

- The debt-to-equity conversion could reduce VIL’s debt by Rs 16,000 crore per year for the next 4 years based on moratorium on spectrum payments.

- Floor tariffs can improve ARPU and revenue for VIL.

- Lower levies would cut annual payouts, improving cash flows.

The reforms may allow Vodafone Idea to invest in expanding 4G coverage, arrest subscriber losses and compete effectively against Airtel and Jio.

Conclusion

The potential government relief measures have sparked hopes of revival for debt-laden Vodafone Idea. While analysts remain skeptical about long-term viability, the reforms may give VIL more time to raise funds, invest in 4G and retain customers.

However, the company will still need to hike tariffs substantially to become profitable over the long run. Investors should watch for more clarity on the relief package and VIL’s fundraising plans.