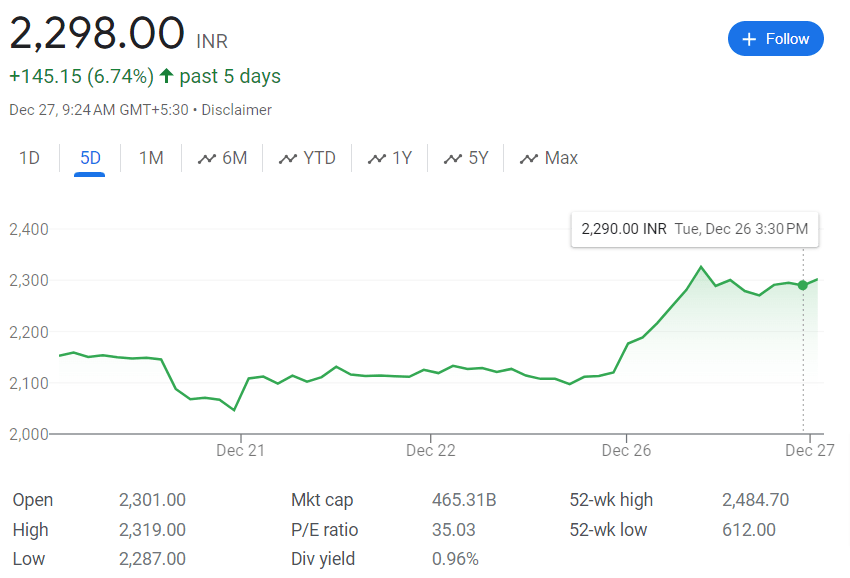

Mumbai-based defense PSU Mazagon Dock Shipbuilders Ltd (MDL) saw its stock price surge nearly 8% on Tuesday to hit an intraday high of Rs 2,288.70 compared to its previous close of Rs 2,125.30.

The shipbuilder has been on a dream run this year, with its stock price zooming 188% year-to-date. Even in the past 5 days, the stock has given stellar returns of 7.57% to investors.

Key Drivers Behind the Rally

Several factors have contributed to the Mazagon Dock scrip’s sensational rally this year:

1. Strong Financial Performance

Mazagon Dock has posted robust financial numbers over the past few quarters, which has boosted market confidence.

In Q2 FY23, the company’s net profit jumped 55% year-on-year to Rs 332.88 crore. Revenues were up 6.8% at Rs 2,100 crore. Further, the order book position remains healthy at Rs 540 billion, which imparts revenue visibility for 2-3 years.

2. High Investor Interest

Increasing investor interest has also catalyzed the stock’s surge. Analyst coverage on the stock has risen, with 2 analysts currently tracking the stock. Out of these, 1 analyst has a strong buy rating on the stock.

Moreover, FII shareholding in the company has also increased to 3.69% in September 2022 quarter compared to 2.51% in the June 2022 quarter.

3. Strong Macro Tailwinds

The government’s increasing focus on indigenization and ‘Make in India’ in defense is benefiting companies like MDL. Budgetary allocation for defense CAPEX has also been rising.

Recently, the Cabinet Committee on Security approved the construction of 6 conventional submarines under Project 75I, which will benefit MDL.

The company is also benefiting from India’s push to increase defense exports. MDL is engaged in constructing/refitting several naval platforms for export customers.

Valuations – Expensive, But Justified

At current price, Mazagon Dock is trading at a TTM P/E multiple of 33.3x, compared to the sector average of 34.2x. Thus valuations appear aligned to sector averages.

The premium valuation is justified considering the company’s near monopoly, healthy order book and robust growth outlook.

Among peers, Cochin Shipyard is trading at a P/E of 16.4x, while Reliance Naval and Engineering Ltd is at 6.8x. Market leader Larsen & Toubro trades at 24.1x.

Thus Mazagon Dock continues to command a premium versus competitors owing to its leadership position and bright prospects.

Outlook – Bullish, Further Upside Likely

The outlook for Mazagon Dock remains very positive owing to:

- Strong order pipeline and order inflow momentum

- Rising defense capex by the government

- Gaining market share in defense shipbuilding

- Potential opportunities from PLI scheme for shipbuilding

- Strong financial performance

Further upside in the stock is likely as the company continues to deliver on healthy order book and posts robust growth numbers.

The stock appears poised to continue its dream run in 2023 as well on the back of bullish industry dynamics and company-specific tailwinds.

Should You Buy Mazagon Dock Shipbuilders Now?

- Mazagon Dock Shipbuilders stock remains an attractive pick for investors with an investment horizon of 2-3 years.

- The company’s near monopoly in defense shipbuilding, robust order pipeline, expanding global footprint and benefits from the China+1 policy make it a formidable player.

- Valuations may appear slightly expensive, but are justified given the high growth potential. Investors could consider buying on dips.

- However, investors need to be aware of concentration risk as MDL is dependent on defense capex. Execution delays could impact performance.

- Overall, Mazagon Dock Shipbuilders is a stock worth having in one’s portfolio considering the bright prospects. The current momentum and positive triggers make this a good time to buy into the company’s long-term growth story.

What does Mazagon Dock Shipbuilders manufacture?

Mazagon Dock Shipbuilders Ltd (MDL) is engaged in the construction and repair of warships and submarines for the Indian Navy and other types of vessels for commercial clients. The company manufactures naval ships including frigates, destroyers, corvettes, landing ship tanks, etc.

What is the order book position of Mazagon Dock?

As per the latest disclosed data, Mazagon Dock Shipbuilders has a strong order book position of around Rs 540 billion, which provides revenue visibility for 2-3 years. The company has orders for construction of naval ships, conventional submarines and other defense-related orders.

What is the market share of Mazagon Dock in naval shipbuilding?

Mazagon Dock is the largest defense shipyard in India with a market share of over 75% in naval shipbuilding. It has built over 790 vessels including 25 warships. MDL enjoys a virtual monopoly in constructing submarines and destroyers for the Indian Navy.

What is the outlook for Mazagon Dock’s stock?

The outlook for MDL’s stock remains bullish considering the company’s strong order book, expanding global presence, rising defense spending by India, and potential from the PLI scheme for shipbuilding. Further upside is likely in 2023. However, execution delays could impact stock performance.

Should I buy shares of Mazagon Dock Shipbuilders now?

MDL stock remains an attractive investment considering its leadership position and future growth drivers. Investors could consider buying the stock on dips for a long-term portfolio. However, be aware of concentration risks and factor in expensive valuations.