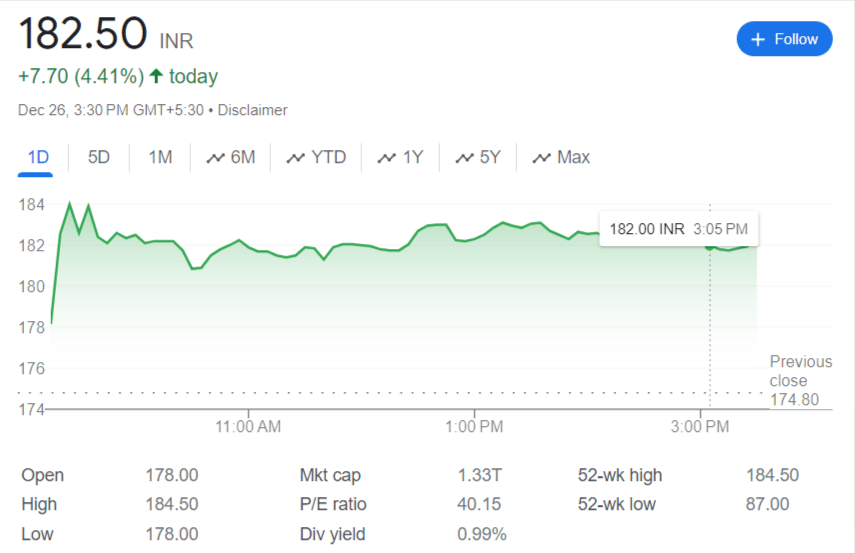

Bharat Electronics (BEL) share price hit a new 52-week high of Rs 184.5, rally 4.4% on the BSE in Tuesday’s opening trade after the state-owned aerospace and defense company said it has signed an MoU with Aeronautical Development Agency (ADA) for co-operation in the field of Aerospace and Defense including UAV/UCAV, software defined radios, modern warfare systems and other futuristic defence technologies.

The defence PSU stock surpassed its previous high of Rs 181.95 touched on Tuesday. In the past six months, BEL share price zoomed 60% as compared to 0.3% fall in the S&P BSE Sensex. should one buy the stock now or wait for further dips? Let’s analyze:

BEL-ADA Pact Aims for Next-Gen Defence Technologies

As per the BEL-ADA pact, both companies will jointly address domestic and international market opportunities in the aerospace and defence sector including:

- Unmanned Aerial Vehicles (UAV) / Unmanned Combat Aerial Vehicles (UCAV)

- Software Defined Radios (SDR)

- Modern Electronic Warfare (EW) systems

- Long Range Dual Band Infra-Red Search and Track System (IRST)

- Active Electronically Scanned Array (AESA) Radar

- Integrated Multi Function Sights (IMFS) for land and naval applications

- Other futuristic technologies having domestic and global demand

Order Book Position Remains Strong

As of January 1, 2023, the order book of BEL stood at over Rs 58,000 crore, offering good revenue visibility for the next few years.

BEL’s diverse portfolio of products and solutions spans every domain of its business from Communication, Radar and Underwater Systems to Electronic Warfare & Avionics, C4I Systems, Electro Optics, Tank Electronics, Homeland Security, Strategic Components and Industrial Automation systems.

With the Government’s increased focus on self-reliance in defence manufacturing, BEL is well positioned to benefit from such policy level tailwinds.

Q3 Results Review – Margin Pressure Persists

BEL posted a decent 14% YoY growth in net profit at Rs 623 crore for the quarter ended December FY23 on the back of 18% revenue growth. However, the margins remained under pressure falling 90 bps YoY and 210 bps QoQ to 21.9%.

The management has guided for improvement in margins in Q4FY23 led by better revenue mix. We believe, execution of the strong order book would support healthy double-digit revenue growth over the next 2 years.

However, margins are expected to remain volatile in the near term given raw material cost inflation and supply chain constraints.

Valuation & Outlook

Post the recent up move, BEL stock is currently trading at P/E of 32.5x its FY24E earnings, at a premium to its 10-year historical average of 27x.

We believe the stock valuation fairly captures the strong order book execution and healthy revenue growth outlook over the next 2 years. However, margin volatility in the near term could act as an overhang on the stock performance.

Overall, we have an accumulate rating on the BEL stock for the long term given its market leadership position in strategic defence electronics and strong order book outlook. Investors can look to buy the stock on dips for a 12-month target price of Rs 210.

Frequently Ask Questions

What does BEL manufacture and supply?

BEL manufactures advanced electronic products and systems for the defence sector in India including radars, communication equipment, electronic warfare systems, avionics, naval systems, electro optics, tank electronics, and more. It also provides services like systems integration, software development, life cycle support etc.

What was the recent deal signed by BEL?

BEL recently signed an MoU with Aeronautical Development Agency (ADA) to cooperate in developing next-generation defence technologies like unmanned aerial vehicles (UAVs), software defined radios, electronic warfare systems, AESA radars, integrated multi-function sights and other futuristic defence equipment.

How big is BEL’s order book currently?

As of January 1, 2023, BEL’s total order book stood at over Rs 58,000 crore providing revenue visibility for next few years.

How were BEL’s Q3 FY23 results?

BEL’s net profit rose 14% YoY to Rs 623 crore in Dec 2022 quarter. Revenues were up 18% YoY. However, margins contracted due to raw material cost inflation and supply chain issues.

What is the outlook on BEL stock and valuation?

We have an ‘Accumulate’ rating on BEL stock for long term given its strong leadership and order book. The stock is trading at 32.5x FY24 earnings. Investors can buy the stock on dips with 12-month target price of Rs 210.