Laurus Labs Ltd (LAURUSLABS) has shown promising signs of an emerging uptrend in recent weeks, leading investors to wonder if now is a good time to buy the stock.

With strong technical indicators, positive analyst coverage, and fundamental tailwinds, there is a strong bullish case to be made for LAURUSLABS. Let’s analyze in detail:

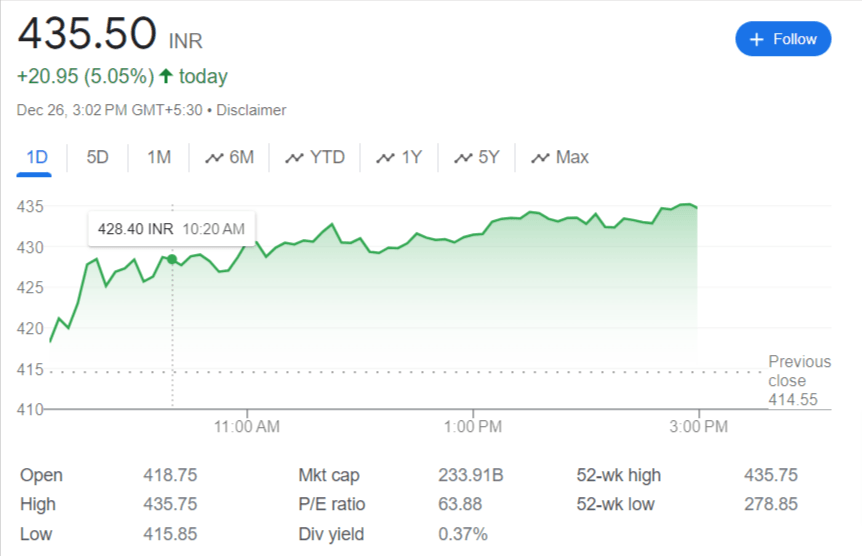

LAURUSLABS Breaks Out with Strong Volumes

On the weekly chart, LAURUSLABS has broken out above a major downtrend line resistance at ₹392, accompanied by strong volumes. This breakout signals a potential change in trend from down to up.

The volumes spiked significantly during the breakout week, indicating an influx of market participation. This validates the authenticity of the breakout.

Furthermore, the stock found support near the crucial 38% Fibonacci retracement level of the previous uptrend at ₹366. This is emerging as a new floor for the stock in the short term.

Indicators Aligning in Favor of Bulls

The daily close above the upper Bollinger band at ₹418 indicates rising momentum in favor of bulls. Historically, closes above the bands have led to sustained up-moves.

The crucial weekly RSI indicator has also given a bullish crossover above the reference line. Such crossovers in the past have resulted in major uptrends for the stock.

The stage seems set for the bulls to assert control after months of correction and consolidation.

Growth Prospects Remain Strong for Laurus Labs

Besides positive technical setups, Laurus Labs also exhibits strong growth prospects in its key business segments:

- The API business continues to benefit from long-term contracts and market leadership in anti-retroviral (ARV) APIs. Operating margins remain industry-leading.

- The synthesis business is riding high on increased outsourcing from global majors. Incremental capacities to further boost growth.

- The formulations business is gaining critical mass, with a robust pipeline of ANDA filings in the US market.

The company has guided for over 25% revenue growth in FY24, signaling continued momentum. Return ratios also remain healthy.

Analysts Overwhelmingly Positive on the Stock

Analysts’ Views

| Ratings | Current | 1 W Ago | 1 M Ago | 3 M Ago |

|---|---|---|---|---|

| Strong Buy | 1 | 1 | 1 | 1 |

| Buy | 4 | 4 | 3 | 3 |

| Hold | 1 | 1 | 3 | 3 |

| Sell | 0 | 0 | 0 | 0 |

| Strong Sell | 3 | 3 | 3 | 3 |

| Total | 9 | 9 | 10 | 10 |

There are 9 analysts tracking Laurus Labs, with 1 strong buy and 4 buy recommendations. No analyst has a sell rating on the stock.

Analysts have price targets ranging from ₹467 to ₹485, implying nearly 15% upside from current levels. The optimistic coverage indicates potential further upsides.

LAURUSLABS: A Summary of the Bullish View

- Breakout from major downtrend line with strong volumes

- Indicators like RSI and Bollinger Bands turning favorable

- Robust growth outlook remains intact

- Most analysts recommend buy/accumulate

Uptrend Resumption Would Target ₹467-485

The stock is showing early signs of trend reversal after months of correction. A sustained move above ₹435 would confirm bullish resumption.

The initial target is at ₹467-485 as per analyst estimates. A close below the recent swing low of ₹380 would negate this bullish view.

So in summary, the emerging technical and fundamental backdrop presents a buying opportunity for investors. The risk-reward ratio seems skewed positively for long term investors.