The SRF stock has shown signs of an impending breakout from its consolidation phase, making it an attractive buying opportunity for investors. However, as with any investment decision, proper due diligence is required before taking a position.

This article analyzes the SRF stock and provides a recommendation on whether retail investors should look to buy the stock at current levels.

Overview of SRF’s Business and Recent Performance

SRF Limited is a chemical manufacturing company based in India. It has a diversified business across fluorochemicals, specialty chemicals, packaging films, and technical textiles.

Over the last decade, SRF has delivered consistent growth in revenues and profits, reflecting the quality of its management and business execution.

In its recent Q2 FY23 results, SRF posted a 26% YoY rise in consolidated net profit to ₹480 crore. Revenues grew by over 30% YoY. This growth was broad-based across all its business segments.

The company is seeing robust demand in India and overseas markets. Higher realizations and volume growth in key products aided the strong financial performance.

Technical Analysis & Recommendation

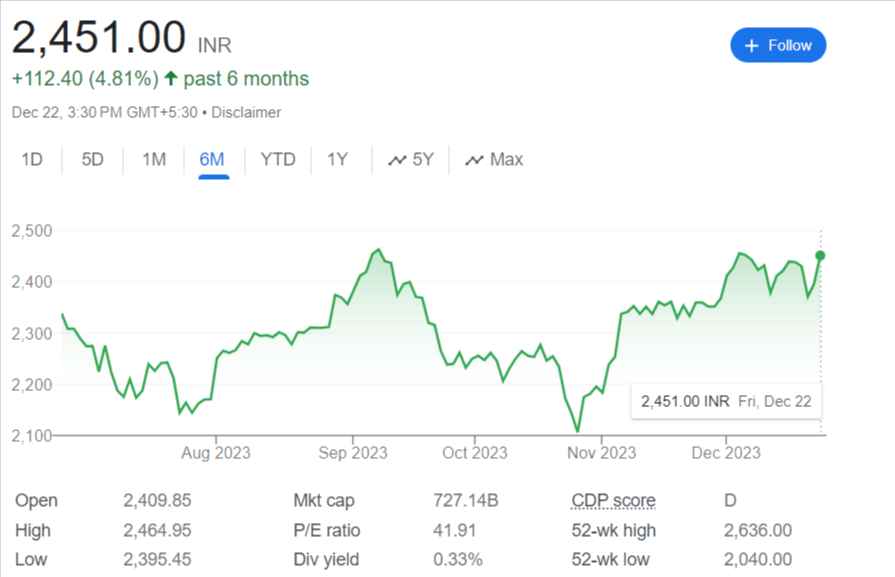

- The SRF stock price has traded in a range of ₹2,300-2,500 over the last six months. This signals a period of consolidation as the stock built a base before its next move.

- In the last three months, the stock has made several attempts to break out above ₹2,500 but failed. This indicated supply pressure at higher levels.

- However, technical indicators have now turned favorable for a breakout:

- The stock recently witnessed high volumes on up-move, indicating increased participation from investors.

- Momentum indicator RSI (relative strength index) displayed a positive crossover after taking support at the midpoint level of 50. This is a bullish sign.

- The stock price has immediate support at ₹2,350. Any dip towards these levels can be utilized as a lower-risk entry opportunity.

- The positive technical setup and fundamentals indicate the stock is poised for a breakout. We recommend a BUY on the stock at CMP of ₹2,425-2,450.

Upside Targets and Stop Loss

The upside targets for the SRF stock are at ₹2,600 and ₹2,650. Once the resistance at ₹2,500 is taken out, the stock can swiftly move to hit these higher target levels.

On the downside, immediate support lies at ₹2,350. If the stock breaches this support in a closing basis, it may lead to profit booking. Hence, we recommend keeping a strict stop loss at ₹2,350 per share.

What Should Investors Do?

Here are some suggested actions for retail investors:

- Enter a buy position at CMP of ₹2,425-2,450 with an upside target of ₹2,650.

- Keep a stop loss at ₹2,350 on closing basis to limit downside risk. Book profits if stop loss is hit.

- On reaching target levels, consider booking partial profits and ride the remaining position with a trailing stop loss.

- Stick to pre-determined entry, exit and stop loss levels for discipline.

- Alternatively, investors with a high-risk appetite can look to buy on dips at support of ₹2,350.

- Allocate only a small portion of your capital to a single stock for better risk management.

The technical setup combined with SRF’s strong fundamentals makes it a stock likely headed higher in the medium-term. Investors should conduct further research and monitor price action before taking any position. Follow sound risk management to optimize reward potential from this opportunity.