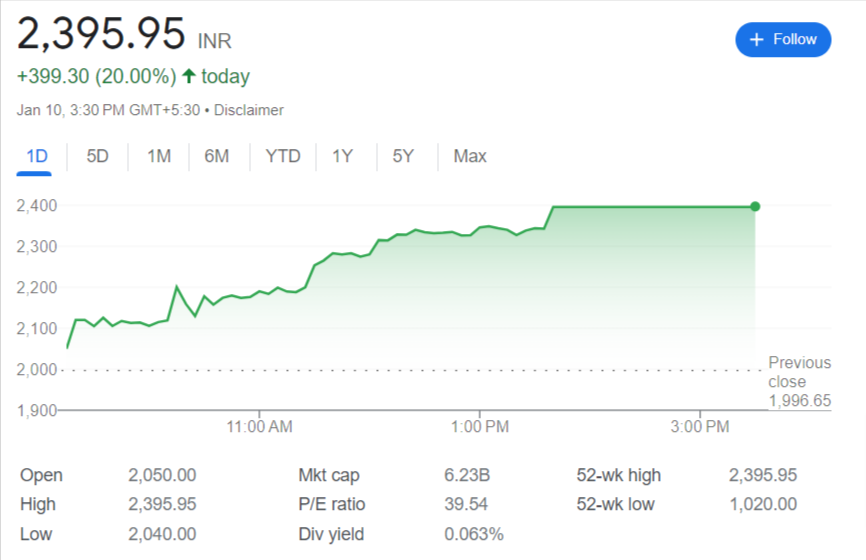

Apollo Sindhoori Hotels share price up 20% on Wednesday, setting a new all-time high for the year. Investors were drawn to the Ayodhya connection, as the opening of the Ram Mandir is coming up in just 10 days. But does the excitement show that the sharp rise is worth it?

All Eyes on Ayodhya Hospitality Space

The Ram Mandir bhoomi pujan is scheduled for January 22 and is expected to bring in lakhs of devotees. As a result, stocks in hospitality companies with a connection to Ayodhya are becoming more popular.

One of these small hotel chains is Apollo Sindhoori, which runs the “Kanha Bodhi” service flats in Ayodhya along the Panchkoshi Parikrama.

Huge numbers of tourists are expected, and investors are betting that the company will be one of the biggest winners from the demand for guesthouses and other places to stay.

In the past year, Sindhoori stock has almost doubled as people wait for this possible growth spark. But will the positivity last?

Ayodhya Realty – Multi-Year Growth Runway

Experts in the field say that Ayodhya has strong secular tailwinds that can keep the real estate market growing in many ways for years to come.

Large-scale infrastructure projects worth thousands of crores are already under way because the UP government wants to make Ayodhya a global heritage tourist hub.

An international airport, train connections, upgrades to the road network, and large areas of land set aside for hotels are all signs that the government wants to make Ayodhya a must-see place.

As connections get better and services get bigger, the hospitality real estate boom that follows could last for more than ten years.

Read More: Ayodhya 2.0: Ram Mandir Town Turns Real Estate Goldmine

Does 20% Single-Day Surge Make Sense?

The story of structural growth seems set in stone, but some experts think investors may have lost their cool during the recent 20% stock surge.

The present market value of Apollo Sindhoori is more than ₹850 crore, which means that the company is worth a lot more than what it is worth.

Given that only one property in Ayodhya brings in a few tens of thousands of rupees, the sudden rise in sales seems like an overreaction to the event-based cause of the temple opening.

Apart from that, big companies like Indian Hotels Co, Lemon Tree, and Lodha Group also have big plans to grow in Ayodhya. As a result, the level of competition may rise faster than expected.

What Lies Ahead for Apollo Sindhoori Stock?

In conclusion, Ayodhya’s hospitality market has a lot of room to grow as Uttar Pradesh plans big tourist projects around it.

With its innovative first-mover edge, Apollo Sindhoori is in a good position to take advantage of the chance.

At the moment, though, stock prices seem to have gone way beyond what the facts will show. Before putting up a lot of money, investors should wait for proof that financial measures are actually speeding up.

At this point, the risk-reward seems to be equal. People who already have money in the stock can hold on to it with trailing stop-losses, while others may want to book some gains.

After the sharp rise, it’s best not to buy anything new until the Ram temple pilgrim rush starts and business clarity for FY2025.